By Ashley McIlwain

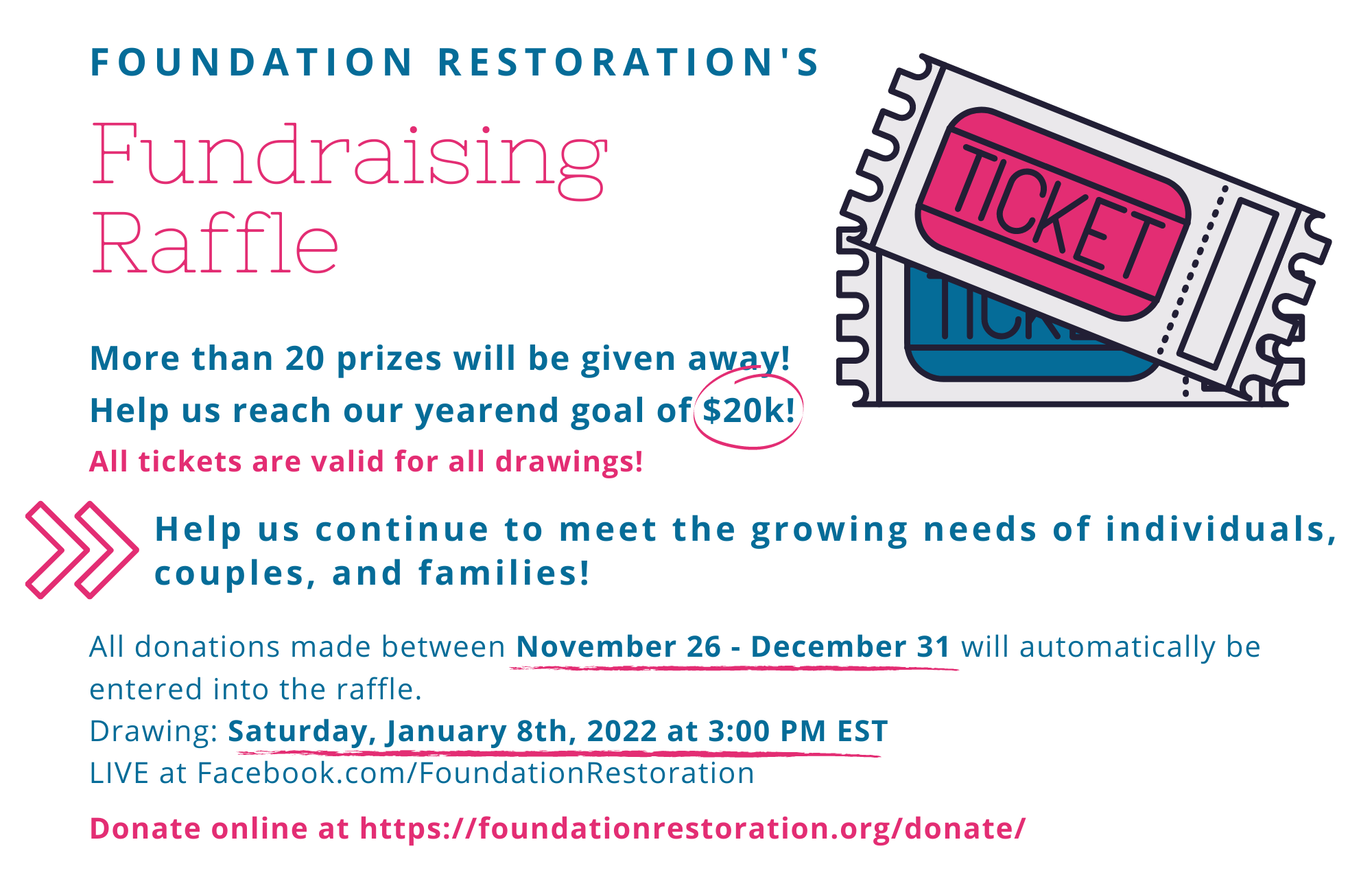

Note: There is a GIVEAWAY included with this interview! See below.

Money affects each of us every single day in one way or another. It matters not whether it’s spending or trying to save, the possession of or lack of money, we find ourselves stuck in this perpetual and vicious cycle that can consume and devour us more quickly than the most addictive of drugs.

Many of us need to look no further than our marriage to see this negative impact of money upon our lives. Often it feels as though a war is being fought to establish the handling of money in a household, a war that leaves many marriages in shambles, and all too often, a casualty.

Scott and Bethany Palmer, also known as “The Money Couple,” are all too familiar with the realities of money’s destructiveness. Having a combined total of forty-three years of financial planning experience, they have witnessed countless couples who, despite having the perfect financial plan, have found themselves divorced as a result of money issues. Through years of research and experience, The Money Couple have cracked the code on marriage and money.

In their new book, The 5 Money Personalities, The Money Couple discuss in detail how you can overcome your marriage’s money hurdles in a simple and fun way. Recently I sat down with them to talk a bit more about their book and the secret to overcoming money problems in marriage.

Ashley: Tell us a little bit about what inspired you to write your new book, The 5 Money Personalities.

Scott: If you go back ten years to the heartbeat of when The Money Personalities started, we were asked by David C. Cook what type of book we’d like to write. We took a couple of weeks to really think about that.

At the time, we were dealing with a high net-worth couple who had all of the boxes checked – an amazing retirement, great income, and workable budget – and they were getting a divorce. I said to them, “Why are you getting a divorce?” assuming it was infidelity or something like that. He said, “Money.” I was like, “You guys are nuts! Look, it’s all here. This is divorce proof.” He said, “No, we just can’t get along about money.” That really hit me and made me mad.

We started to do a lot of research and discovered that we’ve got a 50% divorce rate in this country and 70% of those divorces are over money. That’s what started all of this. As financial planners, what we had been taught and what we had done professionally still lead to couples only having a 50% survival rate. That didn’t sit well with us.

Bethany: It was a ten year journey to say, “We didn’t quite get it.”

What is a Money Personality?

B: It’s your perspective of money.

S: It’s how you view money. That’s why it can never change. The Five Money Personalities are Saver, Spender, Risk Taker, Security Seeker, and Flyer. We believe it’s in your DNA. When you are born, you are already leaning primarily toward one of these, along with a secondary view.

We created the Money Personality Profile online. We had hundreds of questions from as many couples, and then we got a statistical scientist from Stanford to do the profile for us so you could discover your money personality. Those money personalities are who you are, and there’s no way of getting around them.

B: A lot of people wonder if it can change because of circumstances or their parents. No, if you are a Saver, you are a Saver. It is who you are, and that is how God made you. It’s a great thing, but we get shamed for our money personalities. We aren’t encouraged in the positive parts of our money personality, but it really does drive the way we see life. That’s why God talked about money more than anything else because we believe He knows that the way you view money is really how you view life.

S: Finding that we have four money personalities in our relationship, we ask, “Are we savable?” Absolutely! You can tell the saver to lighten up once in a while and live life. The Spender needs to have the reigns pulled back occasionally. This is something we call the opposite dynamic which is where on one side you have your Savers and Security Seekers. On the other side you have the Risk-Takers, Spenders, and Flyers.

B: This opposite dynamic is huge. It’s not just the five money personalities; it’s the dynamic of them.

How can someone and their spouse find out just what are their Money Personalities?

B: You take the Money Personality profile online. Then pass the mouse to your spouse and have them take it. Then get the book, and it will all click.

Why is it so important for a couple to find out what their Money Personalities are?

S: If you look at it from a Biblical standpoint, there are over 2,500 references to money in the Bible, which is more than love and prayer combined. God knew that money was going to be a big issue. It’s the money relationship though; it’s not the money. We’ve become a society that’s become really good at checking boxes. Every one of my friends who has gotten divorced, has gone into counseling for 2-3 months to check that box. “We tried, and now we can check that box off and say there was no way we could keep our marriage together.” The same is true of money. They go to a financial planner to get some peace, and they conclude that you can do all the financial planning in the world, and you’re not going to have financial peace unless you’re on the same page as your spouse.

B: I was listening to a personal finance expert, who was saying, “Make sure you have a thousand dollars saved at the beginning of the year.” That’s his suggestion. That’s a great idea, but if you don’t have a “why” that’s important, the Risk Taker is saying, “Well, I can take that thousand dollars and invest it somewhere.” The Saver then says, “We have to…We have to… They told me to…” The stress that comes with one little thing someone says can bring so much emotional challenge inside the relationship. If they don’t talk about why they’re doing what they’re doing and how it impacts both of the money personalities, it can be good sense, but not work. You have to think about how the other person is going to hear it.

If you don’t understand the “why” behind something, it’s just motions.

B: Yes! It’s just a to-do, and that’s what finances are. Finances are an important to-do list, like planning for retirement, but it needs to go beyond that. When you’re talking about day-to-day decisions where money’s involved (which is just about everything) you need to see eye-to-eye and understand from where the other person’s coming.

In The 5 Money Personalities, you mention that 75% of the couples with whom you work, have differing Money Personalities. How can a couple overcome their differences to have a healthy and functional Money Relationship?

S: Knowledge is the key.

B: Here’s the key to getting along: having a money huddle. Once a month for forty-five minutes be totally focused on your money relationship, not on your finances, although that’s important. We use the acronym END – Evaluate, Needs, Dreams. Spend fifteen minutes just looking at the amount of money you have in savings and the amount of money you have in debt without trying to make the debt go away. That way you know those two numbers and are on the same page, which is important because they drive your money relationship. Then take fifteen minutes to discuss your needs in the money relationship. Finally, spend fifteen minutes to discuss your dreams for the future. If you take just forty-five minutes a month to talk about the one thing that impacts your relationship more than sex, it will dramatically improve things. The goal is to connect and to understand how your money personalities are playing out inside of your relationship.

Scott and I love to talk about our dreams, future, and where God is going to take us. If you don’t talk about it though, then you don’t have that intimacy. Intimacy is what we want inside our relationship. You can’t have intimacy if you don’t talk about your money relationship. We believe it’s not even possible. You can have a good relationship, but wouldn’t you rather have a great relationship? A great relationship!

S: Well stated, and I think it’s cracked the code on divorce.

How can The 5 Money Personalities be helpful in preventing divorce?

S: Well, 70% of divorces are over money. I don’t think Beth and I have had an argument about money in five years. The arguing goes away when you work on your money relationship. This is the reason why you do those money huddles; you feel heard. You’re needs are being established in the relationship, and when your needs are being met and you feel heard, you really have to go out of your way to get in a fight about money.

S: A Security Seeker and Spender have to say to one another, “Hey, half of this money is yours. I will give you the freedom to do this or that, but it just needs to be done within these parameters.” We tell people to compromise in each of your relationships. Well, how do you compromise if you don’t know what you’re compromising about or why it’s important to your relationship?

B: Or, if you don’t think the compromising is ever going to end? This dynamic is never-ending, and finally after a while, you’re just like, “I give up.” If you really start listening to the conversations of all of the couples with whom you interact, they’re really talking about how their money personalities are better.

S: That’s part of cracking the code, too. We’ve got to get over ourselves. We say we can get over ourselves, but not when it comes to money. You need the opportunity to say, “My money personality isn’t the only money personality.” You have to trust your spouse to open your eyes a little bit. It pays off.

Are there any Money Personality combinations that present more of a challenge than others?

S: The Spender/Saver. That’s the hugest one. These are the two that are going to struggle the most. It doesn’t even matter if it’s your primary or secondary money personality. They’re complicated, and those two have the most day-to-day friction.

On the flipside, are there Money Personalities that work best together?

S: We have different opinions on that. I think it can go either way. If you have two Spenders that are married, they’re probably never going to retire, but they’re happy. Money just isn’t a bone of contention for them. Then you might have a couple who has opposite money personalities but have a great relationship because they can talk about it. With us, Bethany makes me do stuff I would never do, and I hold her back every once in a while. I think that’s part of the reason why our relationship is so great: because we love each other for that.

B: I think that the old saying, “opposites attract,” is a God thing. That’s the way God made it; I just don’t think we want to mess with that. Everyone thinks, “I don’t want friction,” but are you going to have an exciting relationship? I really believe that internal friction is God-given. At the same time, I just don’t think you can have that relationship by saying what’s better.

S: It’s really just about what works for that couple.

For dating or engaged couples, what do you think is most important for them to know about the topic of money?

S: Take the Money Personality Profile, read the book, and go into the marriage with your eyes wide open. If you go into a marriage understanding the money relationship, you’ve got a much better fighting chance than most couples because you’re not surprised. People hate money surprises. What happens with so many newlyweds is that they don’t really dive into their money personalities. If you take a money personality profile, and you find out that your boyfriend is a Spender/Risk-Taker, do you think he has credit card debt? I guarantee he does. And if you’re a Saver/Security Seeker, you’re never going to be ok with that. That’s not something you want to find out after you get married.

B: So many people do. Think of all the newlyweds (who never bothered to find out before marriage), who come home, and within the first week, a money surprise happens. They are confronted with that credit card debt they didn’t know anything about. The other person shrugs off their concerns, and all of the sudden you’re freaking out. It can be devastating. It’s just a horrible way to start.

Why do you think it’s so important for all married couples to hear your message?

S: It’s a message of hope. We’ve got to change the way couples think and talk when it comes to their finances. The reason that money fights are some of the worst fights you’ll see is because it’s a personal attack on that person. It’s who they are. That’s why marriages end. You finally get to a point where you don’t feel free to really be who you are in the relationship.

When we date, opposites attract. “He’s taking me out to dinner, buying me flowers, and does all of these great things.” Then you get married and have your first kid, and she’s like, “Stop with the gifts. We need to buy diapers and formula.” All of the sudden, that opposite isn’t the most attractive thing, and they start attacking each other.

B: Where is the excitement in a relationship? It’s at the point of friction. If we never had any friction, what kind of relationship is that? That’s not even a relationship, so if you have no point of friction, it’s not exciting. It’s too boring. You have to have a point of friction, and that’s why opposites attract. I believe that’s why God made it that way. But, when you get beyond the opposites attract, then opposites attack. You have to find the balance to appreciate the friction inside the relationship. Let’s understand the friction, appreciate it, laugh about it, and adapt.

S: And assign things. If Beth comes up with an investment saying, “I have this idea and opportunity,” she knows I’m going to take it and run. I’m going to do the research. She comes up with the ideas, and I do the enforcement. Then we make the decision together. If we can embrace our spouse’s money personality, the money friction is gone.

B: You know how people say that after fifty years couples start looking like each other because they are so in tune? Well, it’s really interesting because, in our own relationship, we’ve picked up one another’s money personalities. Scott will mention an idea or investment because he knows it’s safe, and I will talk about looking into it more. We’ll look at each other and go, “That was freaky that we just had that conversation.” That’s when you become one though, because you’re not threatened by that other money personality. You create space for it, and it’s fun.

Is there anything you especially hope that readers of your new book will take away?

S: If we can get couples on the same page, it’s going to radically change the divorce rate. I believe God gave us this message. If we can get couples talking, and we can get them thinking this way, we’re going to save marriages. I think we can drop the divorce rate by 10% if we can just increase this dialogue.

B: That’s our goal. To decrease the average national divorce rate by 10%. I believe that we can do it.

S: We’ve made everything so complicated with our financial world. This is a message of hope that’s not complicated.

B: It’s very simple. It’s not hard or complicated, but it’s very important. We believe that it’s foundational.

Thank you to Scott and Bethany Palmer for sharing their insights with us! You can get a copy of their new book, The Five Money Personalities, by clicking here. You can also get more information about The Money Couple and their book, as well as take the Money Personality Profile on their website.

Copyright © 2013, Foundation Restoration. ALL RIGHTS RESERVED. No reproduction allowed without written permission from Foundation Restoration and/or the author.

Congratulations to our winners … Lauren L., Pat, and Erin!!!

PLEASE READ INSTRUCTIONS CAREFULLY to ensure eligibility! LEAVE A COMMENT below on today’s article to get entered to win our 5 Money Personality Giveaway (EVERYONE MUST LEAVE A COMMENT TO GET ENTERED). For additional entries do one or more of the following (each item is clickable to take you where you need to go) AND MAKE SURE TO INCLUDE WHICH YOU DID IN YOUR COMMENT BELOW!!! If you have already done any of the items listed below (for example, you “liked” us on Facebook prior to this giveaway), make sure to still include which you did in your comment below (ALL ENTRIES WILL BE VERIFIED, so please be honest)!!!

- LEAVE A COMMENT on this post INCLUDING all of the following actions you have taken!

- LIKE FOUNDATION RESTORATION on Facebook!

- FOLLOW FOUNDATION RESTORATION on Twitter! (Leave your username in your comment – i.e., @FndRestoration)

- TWEET about this giveaway!

- FOLLOW FOUNDATION RESTORATION on Pinterest!

- SIGN UP to receive the free FOUNDATION RESTORATION e-newsletter!

Entries must be received by Friday, March 1st at midnight Pacific Standard Time. Winners will be selected randomly and notified by email. Make sure to add info@foundationrestoration.org to your contacts to ensure delivery of the email. Winner will have 3 days to respond before winnings are forfeited. Open only to those living in the U.S. (So sorry:()

This was a best interview. It made sense about the different personalities when looking at my own marriage!! we are complete opposites and have only recently been tackling the compromise aspect.

I receiver your newsletter

following on facebook (lauren lawson)

I tweeted the link

following on twitter (auntlala25)

Wonderful and highly informative interview! Thanks for the insight.

A great resource and interview for such an important topic!

Our differing approaches to money, what it represents and how to deal with financial issues are at the core of why our marriage is struggling. Maybe this book, if both my wife and I will read it and use it to understand our differences and come up with a unified approach to money issues, would help us begin to heal this marital wound.

Thanks for the info!!!! I have liked you on facebook and Shared it also. Thanks again for everything and keep up the wonderful work!

What you say makes a lot of sense. Talking about your dreams together does help a marriage, but it is not always easy to do.

DEAR SCTT AND BETHANY PALMER,

MY COPY OF THIS BOOK JUST CAME N AT BARNES AND NOBLE

TODAY ON CD’s TRUDY ORDERED THE 5 MONEY PERSONALITIES

ON CD’s LAST SATURDAY MORNING DOES THIS COME IN A COMBO SET WITH COPY OF A PRINT COPY ALSO SCOTT AND BETHANY PALMER?

YOURS TRULY

TRUDY HALL